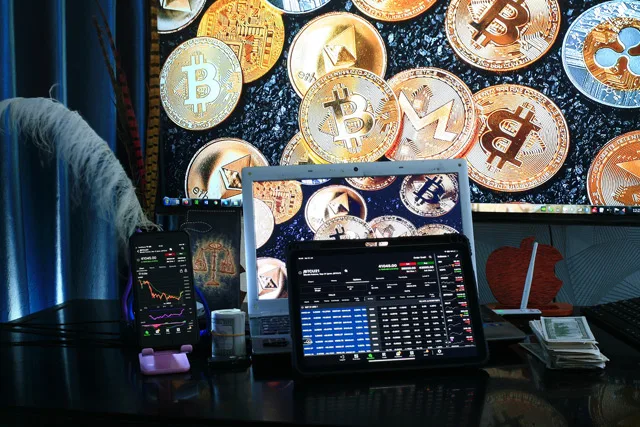

The cryptocurrency market is constantly evolving, and new projects are emerging all the time. It can be difficult to keep track of all the latest developments, and even more difficult to know which cryptos are worth investing in. In this article, we will take a look at the top 10 best performing cryptos in 2023. These cryptos have all shown strong growth potential and have the potential to generate significant returns for investors.

1. Bitcoin (BTC)

Bitcoin is the original cryptocurrency and remains the largest and most well-known crypto asset. It is a decentralized digital currency that is not subject to government or financial institution control. Bitcoin has a limited supply of 21 million coins, which makes it attractive to investors who believe in its long-term value.

Official link: https://bitcoin.org/

2. Ethereum (ETH)

Ethereum is the second-largest cryptocurrency by market capitalization. It is a decentralized platform that allows developers to build and deploy smart contracts and decentralized applications (DApps). Ethereum is also the home of Ether (ETH), the native cryptocurrency of the Ethereum platform.

Official link: https://ethereum.org/

3. Solana (SOL)

Solana is a high-performance blockchain platform that is capable of processing thousands of transactions per second. It is a popular choice for developers building DApps and other decentralized projects. Solana also has its own native cryptocurrency, SOL.

Official link: https://solana.com/

4. Cardano (ADA)

Cardano is a third-generation blockchain platform that is focused on scalability and security. It is designed to be a more energy-efficient and sustainable alternative to other blockchain platforms. Cardano also has its own native cryptocurrency, ADA.

Official link: https://cardano.org/

5. Avalanche (AVAX)

Avalanche is a high-performance blockchain platform that is designed to be scalable, secure, and sustainable. It is a popular choice for developers building DApps and other decentralized projects. Avalanche also has its own native cryptocurrency, AVAX.

Official link: https://www.avax.network/

6. Polkadot (DOT)

Polkadot is a blockchain interoperability platform that allows different blockchains to communicate and share data with each other. It is designed to create a more unified and interconnected blockchain ecosystem. Polkadot also has its own native cryptocurrency, DOT.

Official link: https://polkadot.network/

7. Terra (LUNA)

Terra is a blockchain platform that is focused on decentralized finance (DeFi). It is designed to provide users with access to financial services without the need for intermediaries. Terra also has its own native cryptocurrency, LUNA.

Official link: https://www.terra.money/

8. Binance Coin (BNB)

Binance Coin is the native cryptocurrency of the Binance exchange. It is used to pay for transaction fees on the Binance exchange and to access exclusive features and benefits. Binance Coin also has its own blockchain, the Binance Smart Chain, which is used to power a variety of DApps and DeFi projects.

Official link: https://www.binance.com/en/bnb

9. USD Coin (USDC)

USD Coin is a stablecoin that is pegged to the US dollar. It is a popular choice for investors who want to store their value in cryptocurrency without having to worry about volatility. USD Coin is also used in a variety of DeFi applications.

Official link: https://www.centre.io/

10. Tether (USDT)

Tether is another stablecoin that is pegged to the US dollar. It is the most popular stablecoin in the cryptocurrency market and is used in a wide variety of applications.

Official link: https://tether.to/

Conclusion

The cryptocurrency market is a volatile and unpredictable place. There is no guarantee that any crypto will perform well in the future. However, the cryptos listed in this article have all shown strong growth potential and have the potential to generate significant returns for investors.

It is important to do your own research before investing in any cryptocurrency. You should consider your own risk tolerance and investment goals before making any investment decisions.

Also Read: